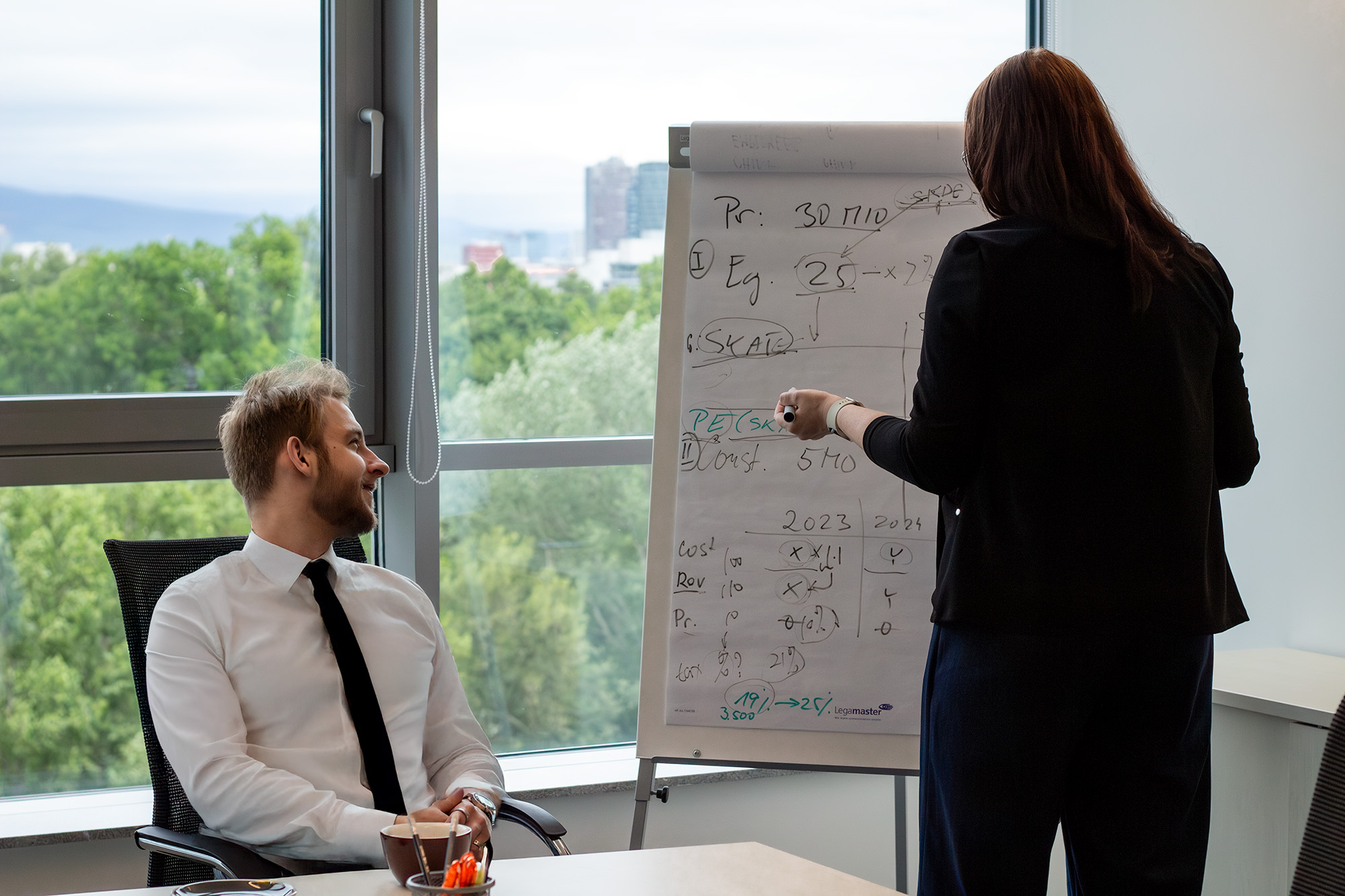

Correctly paying insurance contributions and taxes is a fundamental duty of every employer. Failure to meet deadlines can result in the automatic imposition of penalties by the Social Insurance Agency without prior notice. Therefore, it is essential to be aware of the exact rules and due dates to avoid unnecessary financial penalties and administrative complications.

The Social Insurance Agency automatically imposes penalties without conducting an inspection.

By Section 178(1)(a), point nine of Act No. 461/2003 Coll. on Social Insurance and Section 240 of the Act, as amended, the Social Insurance Agency imposes penalties once a year for overdue insurance payments.

What is the deadline for making correct contributions to the Social Insurance Agency?

Insurance contributions are due on the day designated for employee payroll. Therefore, if the employment contract specifies a date for employee payroll, for example, the 10th day of the month, this date also affects the payment of insurance contributions and is also stated in the monthly statement of insurance and contributions.

Insurance contributions paid and remitted by the employer are due on the designated day for income payment.

It is essential to ensure that the day designated for income payment stated in the report matches the actual day set for income payment by the employer. Late payment of insurance contributions is subject to a penalty of 0.05% of the amount due for each day of delay.

Suppose the payment of employee income for individual and organizational units of the employer is staggered on different days. In that case, the advance insurance payment is due on the day of the last income payment to employees accounted for in the respective calendar month.

If such a day is not determined, the insurance contribution is due on the last day of the calendar month following the month for which the insurance is paid.

If the due date falls on a Saturday or a public holiday, the insurance contribution is due on the next working day.

How to prevent penalties?

The only way to prevent penalties is to state in the employment contract that the payment date is not specified and the salary is payable in arrears for a monthly period no later than the end of the following calendar month.

What is the due date for advance payments for public health insurance?

The advance payment for employees' insurance is due on the designated day for payment of employees' income for the respective calendar month.

Suppose the payment of employee income is staggered on different days for individual, organizational units of the employer. In that case, the advance insurance payment is due on the day of the last income payment to employees accounted for in the respective calendar month.

If such a day is not determined, the advance insurance payment for the respective calendar month is due on the last day of the calendar month following the month for which the advance insurance payment is made.

And what about the payment of advance income tax from dependent activities? How do you avoid interest on late payments?

The employer, who is a taxpayer, shall remit advance tax payments, reduced by the total tax bonus, no later than five days after the day of payment, transfer, or credit of taxable wages to the employee unless the tax administrator specifies otherwise at the employer's request.

For delayed remittance of advance payments for income tax from dependent activities, the tax administrator may impose interest on late payment on the amount due for each day of delay up to and including the date of payment.

A responsible approach to adhering to deadlines for paying insurance contributions and taxes is crucial for the smooth operation of a company and the prevention of unnecessary financial penalties. Accurate record-keeping and consistent monitoring of deadlines will allow you to avoid complications and ensure smooth cooperation with the relevant authorities.

Be the first to know about the latest information from the world of taxation, accounting and auditing.